eBay 1099-K Explained for 2025: Thresholds, Write-Offs, and What to Do

eBay 1099-K threshold 2025 explained. State rules, deadlines, penalties, and how to reconcile gross payments with fees, refunds, shipping labels, and COGS.

December 17, 2025

How to Handle an eBay 1099-K in 2025: Thresholds by State, Refunds and Fees, COGS, Write-Offs, Extensions, and Penalties

This is plain-English education, not tax advice. A CPA or enrolled agent should confirm how it applies to you.

What the 1099-K threshold is for 2025

For tax year 2025, eBay says you will receive a Form 1099-K if you had more than $20,000 in gross payments and more than 200 transactions.

That is the “threshold” people keep talking about.

Here is the part most sellers miss: the threshold only decides whether you get the form. It does not decide whether you owe tax, and it does not decide how much tax you owe.

Gross payments vs profit (this is the part most sellers misunderstand)

The number shown on your eBay 1099-K is gross payments, not profit.

Gross payments refer to the total amount buyers paid before real-world costs are deducted. This includes money that never actually ended up in your pocket in the long term.

Profit is what remains after you subtract the costs of running your selling activity. This includes what you paid for the item, eBay selling fees, promoted listing fees, shipping label costs, packing supplies, and refunds.

This is why a 1099-K often looks scary. A seller might see $40,000 on the form and assume they owe tax on $40,000. In reality, that same seller might have only kept $6,000 after expenses, or even less.

The IRS understands this difference. The 1099-K is not meant to show profit. It is meant to show payment activity, which you then reconcile on your tax return using your records.

If your records are clean, the 1099-K becomes a reference number, not a problem.

If you want a simple way to think about profit before tax season hits, read How to Price Your eBay Listings for Profit (and When to Adjust). It breaks down why gross sales can look big while profit stays small, and what to change when margins feel tight.

Why is everyone making a big deal about it

A 1099-K shows a big number. That big number is not your profit.

It can include money that later gets refunded, and it does not subtract your eBay fees, your shipping label costs, your packing supplies, or what you paid for the item. eBay explains that the 1099-K gross amount does not include adjustments like credits, discounts, fees, refunds, and similar adjustments, meaning those do not reduce the gross number shown on the form.

So the “fuss” is usually not about tax law. It is about sellers realizing they need clean records so they don’t overpay.

States with a lower state threshold

eBay says some states have lower reporting thresholds than the federal threshold. eBay lists these as states with lower reporting thresholds:

- $600: District of Columbia, Maryland, Massachusetts, Montana, Mississippi, North Carolina, Vermont, Virginia

- $1,000: Illinois, New Jersey

- $1,200: Missouri

- $2,500: Arkansas

If you do not live in one of those states, your 2025 threshold is the standard rule: more than $20,000 and more than 200 transactions.

Also, remember the exception: if backup withholding applied, you can receive a 1099-K even if you did not hit the normal threshold.

What a 1099-K is and what it is not

A 1099-K is an information form. It is eBay telling you and the IRS how much money was processed for you through the platform.

A 1099-K is not a tax bill. It does not tell the IRS your profit. It does not know what you paid for inventory, what you spent on shipping, or what your real business costs were.

One more important point: you do not file a 1099-K. eBay issues it. You use it (plus your records) to prepare your tax return correctly.

1099-K vs. 1099

A 1099-K is about payments processed by a platform or payment company for goods or services.

Not to be confused with other “1099 forms” that are used for other kinds of income. For example, 1099-NEC is commonly used when a business pays a contractor, or 1099-MISC that is commonly used for other types of income (rents, prizes, etc). Most eBay sellers are dealing with 1099-K, not 1099-NEC or 1099-MISC.

How eBay calculates the 1099-K number

eBay says Form 1099-K reports the gross amount of reportable payments within a calendar year, based on when gross funds are processed by eBay.

eBay also says the gross amount does not include adjustments such as credits, discounts, fees, refunds, or similar adjustments. eBay also states that sales tax and canceled transactions are excluded from the gross amount reported.

That combination is why sellers get confused. Refunds and fees may be real and painful, but they usually do not reduce the big gross number shown on the 1099-K. Your records are what prove the difference.

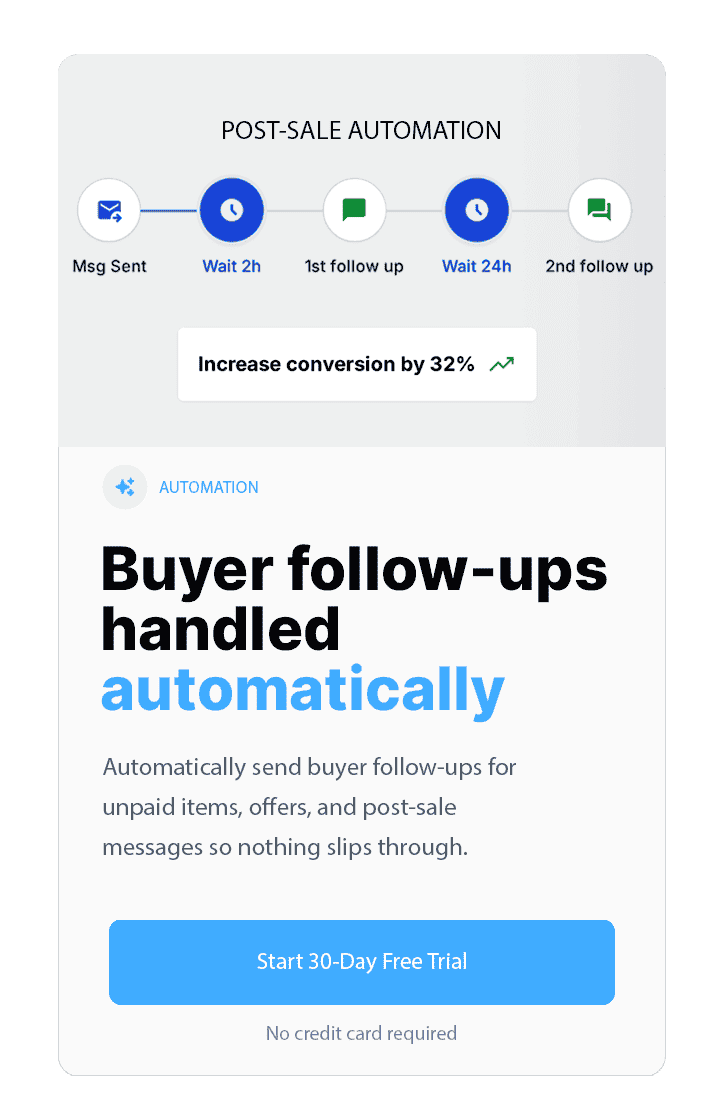

If shipping labels and fulfillment costs are a big part of your business, read The Best Automation Strategies for eBay Sellers. It explains how sellers reduce label errors and time spent on shipping, keeping those costs visible and under control.

What it looks like at different sales amounts

If you sold $500 on eBay in 2025, most sellers will not receive a 1099-K under the standard rule, but you still should keep basic records. If you live in one of the lower-threshold states, you may receive one at lower amounts.

If you sold $1,000 or $5,000, the same idea applies. The form is about the reporting rule. Your tax is about your profit. The IRS also says platforms may send a 1099-K even when payments are below the threshold.

If you sold $20,000 but had fewer than 200 transactions, many sellers will still not receive a 1099-K under the standard rule, because the 2025 rule is “more than $20,000 and more than 200 transactions.”

If you sold $50,000 or $200,000, you are very likely to receive a 1099-K if you also have more than 200 transactions, and the IRS will expect your return to match the records that eBay reported. This is where sloppy bookkeeping becomes expensive.

Personal items and why this matters

A personal item is something you own for personal use, such as an old phone, used shoes, or a dining room table.

If you sold a personal item for less than you paid, that loss is generally not deductible. The IRS says you can “zero out” the reported gross income so you do not pay tax on it, even though the loss itself is not deductible.

If you sold a personal item for more than you paid, you may have a taxable gain. That is one reason receipts and basic notes matter.

A key point: eBay usually does not know whether something was personal or business inventory. The IRS does not automatically know either. The way this gets handled correctly is through your records and the way your tax return is prepared.

Are there legitimate loopholes to avoid a 1099-K

If by “loophole” you mean a clean, legal trick to avoid reporting taxable income, no.

The IRS is clear that platforms are required to send a 1099-K above the threshold, and they may also send one below the threshold.

Trying to play games just to avoid the form is usually a bad plan. The smarter plan is to track costs and expenses, so you only pay tax on real profit.

When should you “open a business” and is it better

This question has two parts.

First, you can have business income even without forming an LLC. If you buy items to resell regularly and aim to make a profit, you are acting like a business in practice.

Second, forming an LLC is a legal structure decision, not an automatic tax savings button. A single-member LLC is often taxed like a sole proprietor unless you choose something else with a professional.

Many sellers “open a business” when they want cleaner separation, such as a separate bank account, better bookkeeping, or basic legal separation. A CPA can help you decide when that step makes sense for your volume and risk.

Buying lots and not selling everything

If you buy a “lot” of items and you do not sell everything in the same year, that is normal.

In simple terms, the items you did not sell are still inventory you own at year-end. The IRS small business guide shows the general idea of cost of goods sold: you start with beginning inventory, add purchases, then subtract ending inventory to find the cost tied to what you actually sold.

This is why you do not want to guess. You want a clean record of the lot cost and how you split it across the items you sold.

If lots, partial lots, and unsold inventory are where your numbers get messy, read How to Simplify Inventory Management for Your eBay Business. It’s a practical guide to keeping clean records so you can prove what sold, what’s still on the shelf, and your real costs.

What if an item sells in 2025 but gets returned in 2026

The 1099-K is based on the calendar year and on when funds are processed.

So if a sale happens in late 2025 and the return happens in early 2026, the 1099-K might still show the original gross payment in 2025. Your bookkeeping should still capture the refund when it happens. Your CPA can determine the cleanest way to reflect that over the two years based on your situation.

The practical takeaway is simple: track the sale date, the refund date, and the amount. Do not rely on memory.

What sellers can write off

A “write-off” is a business expense deduction that can reduce taxable profit. The IRS explains that to be deductible, a business expense generally must be “ordinary and necessary,” meaning common and accepted for your business, and helpful and appropriate.

For many eBay sellers, the biggest deductions often include inventory cost for items sold (often called cost of goods sold), selling fees, shipping label costs, packing supplies, software, and business-use portions of phone or internet.

For car and mileage, the IRS says you generally use either the standard mileage method or the actual expense method, and recordkeeping matters.

For equipment like a laptop or computer used for business, the IRS explains you may be able to deduct the cost through depreciation or by using options like Section 179, depending on the facts.

Do not “make up” deductions like free boxes you reused without any reasonable method. If you cannot explain it with a straight face to a CPA, it is not worth it.

If you’re trying to track fees, receipts, and bookkeeping without building a Frankenstein spreadsheet, see MyListerHub Integrations. It shows how sellers keep accounting and bookkeeping tasks in one place, so tax time is less guesswork and more clean numbers.

How to keep a mileage log in a way the IRS accepts

If you deduct vehicle expenses, you need records. IRS guidance emphasizes keeping adequate records, and Publication 463 covers what records you need to prove expenses.

In plain words, your log should capture the date, where you went, how many miles you traveled, and the business reason. Many sellers use a mileage tracking app. Some people use a small car device, but an app is usually simpler.

Deadlines and extensions

eBay says your 1099-K is issued by January 31.

If you need more time to file your tax return, the IRS says you can request an extension by the April filing due date, and that gives you until October 15 to file. The IRS also says the extension is only for filing, and you should still pay what you owe by the April deadline.

Penalties if you file late or pay late

The IRS says the failure-to-file penalty is generally 5% of the tax due for each month or part of a month your return is late, up to 25%, and there can be a minimum penalty if your return is more than 60 days late.

The IRS says the failure-to-pay penalty is generally 0.5% per month (or part of a month) on unpaid taxes, up to 25%.

If both apply in the same month, the IRS explains how the failure-to-file penalty is reduced by the failure-to-pay penalty for that month.

What to do step by step

Step 1 is to stop thinking about the 1099-K as “tax owed.” Treat it as a matching problem. The IRS receives this form too, so your return should make sense next to it.

Step 2 is to download your eBay tax documents and your details. eBay explains the form, that it reflects gross payments, and that it is tied to the calendar year.

Step 3 is to pull the data you need to explain the differences: refunds, returns, fees, shipping label costs, and your inventory costs. This is how you avoid paying tax on money you did not actually keep.

Step 4 is to reconcile the totals. “Reconcile” just means you make the story match. Your goal is to be able to say, “Yes, eBay reported $X gross, and here is exactly how that turns into my real taxable profit”. For personal items sold at a loss, the IRS explains you can “zero out” so you do not pay tax on them.

Step 5 is to hand your CPA a clean packet. Include your 1099-K, your sales and refund totals, your fees and shipping totals, your inventory costs for items sold, and your mileage and equipment receipts if you are deducting them. If you do not give your CPA the 1099-K, you are creating a mismatch risk because the IRS also has it.

Step 6 is to file on time. If you need more time, file an extension by the April deadline, and still pay what you reasonably estimate you owe.

What about multiple eBay accounts

If you have multiple eBay accounts tied to the same tax ID, eBay combines the payments and transaction counts across those accounts when determining whether a 1099-K is issued. Once the combined activity passes the threshold, eBay can issue a 1099-K for each account.

If you have multiple eBay accounts with different tax IDs, eBay generally evaluates each account separately for 1099-K reporting. However, this does not remove your responsibility to report all taxable income. Using multiple tax IDs is fine when they represent truly separate businesses or legal entities, but it cannot be used to hide income or avoid taxes. When ownership or control overlaps, a CPA should confirm that income is reported correctly.

Quick glossary in simple words:

- Threshold means “the line.” If you cross it, eBay must send you a tax form called a 1099-K.

- Calendar year-based means January 1 through December 31. Your 2025 totals only count what happened inside 2025.

- Gross payments means the big top number. It is not your profit. You eBay 1099-K does not subtract things like discounts, fees, or refunds.

- Profit means what you keep after your costs and allowed expenses.

- Zero out means “report it in a way where you don’t pay tax on money that isn’t really taxable income”. The IRS uses this phrase when you sold personal items at a loss but still got a 1099-K.

- Sole proprietor means you run the business by yourself. There is no separate company by default.

- Single-member LLC means a one-owner LLC. By default, many single-member LLCs are taxed like a sole proprietor, unless you choose a different tax setup with a professional.

- Backup withholding means eBay had to withhold taxes from your payouts because your tax info was missing or didn’t match. In that case, eBay can send a 1099-K even if you didn’t hit the normal threshold.

- Section 179 is a tax rule that allows a business to deduct the full cost of equipment in the year it begins use, rather than spreading the deduction over several years.

Common Questions Sellers Ask:

Does the eBay 1099-K mean I owe taxes on the full amount shown?

No. The amount shown on an eBay 1099-K is gross payments, not profit. It includes the total money buyers paid before subtracting eBay fees, refunds, shipping label costs, inventory cost, or other business expenses. You only owe taxes on your net profit, which is calculated after subtracting allowed expenses from your sales. The 1099-K is a reporting form, not a tax bill.

Do I still have to report eBay income if I did not receive a 1099-K?

Yes. Even if you do not receive a 1099-K from eBay, you are still required to report taxable income from eBay sales. The 1099-K threshold only determines whether eBay must send the form to you and the IRS. It does not determine whether income is taxable. If you made a profit selling on eBay, that profit must be reported.

If you want to see how sellers keep their orders, fees, labels, and records organized without doing it all manually, book a quick walkthrough. We’ll show you the clean way to track what matters, so your CPA gets clear inputs instead of a headache.

by David Green