1099-K for Part-Time eBay Sellers: What Changes, What You Can Deduct, and What to Do

Got a 1099-K from eBay as a part-time seller? Learn what the number means, what you can deduct, and how to avoid overpaying taxes.

December 23, 2025

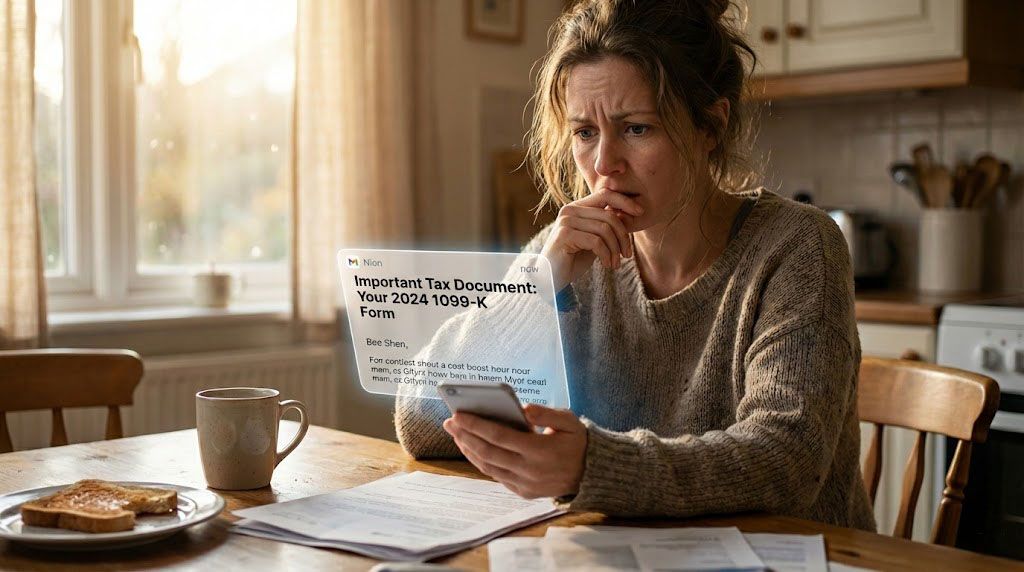

Are You a Part-Time eBay Seller Who Got a 1099-K? Here’s What to Do Next

This article is education, not tax advice. A CPA or tax professional should confirm how it applies to you.

Do not panic

If you received a 1099-K from eBay, the most important thing to understand right away is this: the number you see on the 1099-K is not money you owe, and it is not automatically the amount you will pay taxes on.

The 1099-K shows money that moved through eBay, not money you kept and not money you necessarily made. Think of it like counting how much water flowed through a hose, not how much water stayed in the bucket at the end.

This article exists so you don’t overpay out of fear.

This article is for you if eBay is a side hustle

You are a part-time eBay seller if eBay is not your full-time job, but you sell more than once in a while. You might buy items to resell, sell things from your home you no longer use, clear out a messy garage, make room in storage, or sell items your kids left behind after they moved out. Many part-time sellers mix personal items and resale items without realizing it.

You do not need a business name, an LLC, or a separate company to be in this group. You just need activity that goes beyond a one-time sale.

Why the 1099-K matters once you sell for profit

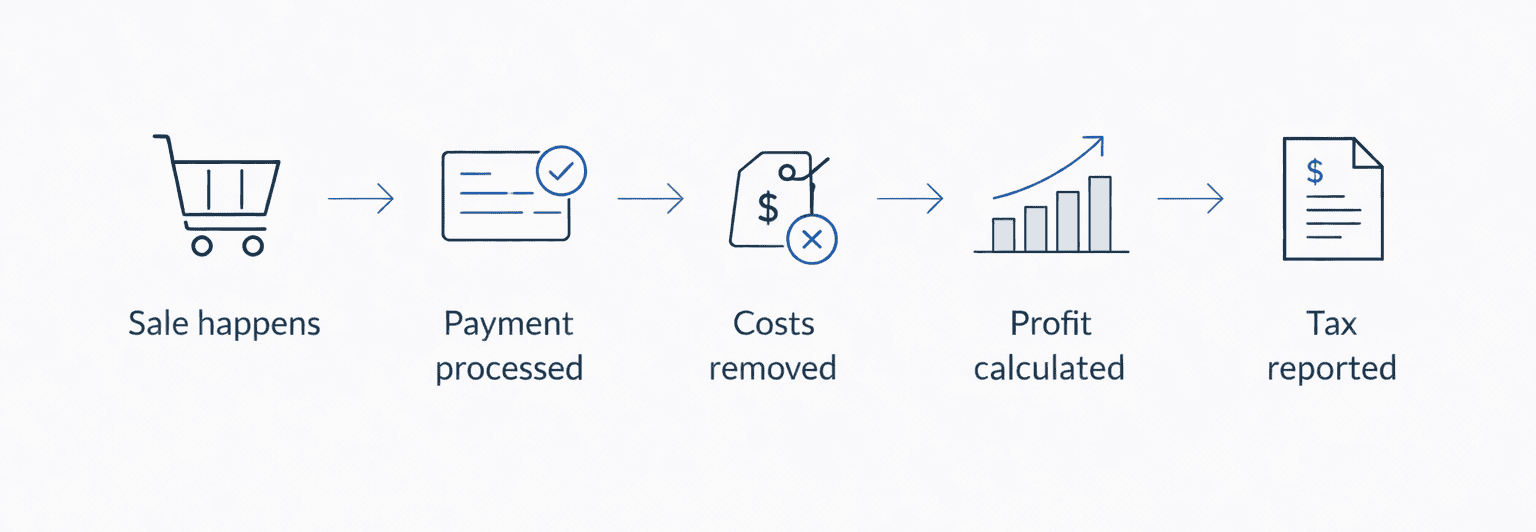

When you only sell personal items occasionally, most sales happen at a loss and taxes are usually simple. When you start selling items with the intention of making money, the IRS expects you to explain how much you actually made, not just how much money passed through your account.

The 1099-K is how the IRS sees your activity from the outside. It shows gross payments, not profit.

Imagine you sell ten items and buyers pay you $1,000 in total. You spent $700 buying those items and another $200 on fees and shipping. The 1099-K may show $1,000, but your real profit is $100. That $100 is what matters for taxes, not the $1,000.

Gross payments vs profit

The number on your 1099-K is called gross payments. Gross payments mean all the money buyers paid before anything is subtracted. It does not remove what you paid for the item, eBay fees, shipping labels, packing supplies, or refunds.

Profit is what remains after all those costs.

For example, you sell a toy for $50. You paid $30 for it, and fees plus shipping cost $15. The gross payment is $50, but your profit is $5. The 1099-K sees $50. Taxes care about the $5.

If your sales look strong but your profit feels small, read How to Price Your eBay Listings for Profit (and When to Adjust). It explains why gross numbers can be misleading and what sellers change to protect margins.

Selling things from your home

Many part-time sellers are not running stores. They are selling items they already owned. This can include old tools from the garage, furniture you replaced, clothes you no longer wear, electronics you upgraded, or items your children left behind.

Selling these items does not automatically create taxable income.

If you bought a chair years ago for $200 and sold it on eBay for $80, you lost money. That loss is not taxable, and you do not owe tax on that sale. Even if eBay reports the payment on a 1099-K, your tax return can reflect that no profit happened.

At what point does this become a business

You do not suddenly become a business one day. You cross into business activity when you regularly buy items with the intent to resell and make money.

If you sell your old bike once, that is personal. If you buy bikes every weekend to resell them, that looks like business activity. You do not need an LLC for this to be true. Intent and consistency matter more than paperwork.

What part-time sellers can usually deduct

When you sell items to make a profit, you are allowed to subtract the costs of selling before calculating taxes. These costs usually include what you paid for the item, eBay selling fees, shipping labels, packing supplies, software used for selling, and the business-use portion of your phone or internet.

For example, if you sell an item for $100, paid $60 for it, and spent $25 on fees and shipping, your taxable amount is based on the $15 left. You are not taxed on the full $100.

Buying lots and not selling everything

Many part-time sellers buy items in lots. If you buy ten items and only sell four this year, you do not deduct the full cost of all ten items.

Only the cost tied to the four items you sold is used this year. The remaining six items are still inventory and will be counted later when they are sold.

This is simply matching costs to income so the numbers make sense.

If you regularly buy lots and struggle to track what sold versus what’s still sitting in boxes, read How to Simplify Inventory Management for Your eBay Business. It explains how sellers keep inventory costs clear so taxes don’t turn into guesses.

What if an item sells this year but is returned next year

This happens more often than people expect. The 1099-K follows the calendar year, not common sense timing.

If you sell an item in December and refund it in January, the sale may still appear on this year’s 1099-K. The refund is recorded when it happens. As long as your records show the refund clearly, you are not stuck paying tax on money you returned.

Multiple eBay accounts

If you have multiple eBay accounts tied to the same tax ID, eBay combines the activity when deciding whether to issue a 1099-K. If each account uses a different tax ID because they are truly separate businesses, eBay generally evaluates them separately.

For example, two accounts using the same Social Security number are combined. Two accounts using two real, separate business tax IDs are treated separately. In all cases, all profit must still be reported correctly.

The rule to remember; eBay follows the tax ID, not the number of bank accounts, the IRS follows who owns and controls the income.

When part-time sellers should consider leveling up

If tax season stresses you out every year because you do not know your numbers, that is a sign. For example, waiting for the 1099-K and then trying to remember what you bought and sold usually leads to mistakes.

If your inventory is growing and you no longer know what you paid for half of it, that is another sign. This often happens when boxes pile up but costs are not tracked.

If your profit is meaningful and losing a few thousand dollars to errors would hurt, that is another signal. At that point, guessing becomes expensive.

If eBay income is no longer “extra money” and has become part of your plan, it is time to treat it with more structure.

What to do when you receive a 1099-K

When the 1099-K arrives, do not ignore it and do not assume the number is taxable. Download the detailed report from eBay and match it to what you actually sold, refunded, and spent.

If the 1099-K shows $25,000 and your records show $18,000 after costs, both numbers matter. You give both to your CPA so the right amount is taxed.

If you want a full breakdown of how the eBay 1099-K works for all sellers, including thresholds, personal items, penalties, extensions, and what changes at higher volumes, read eBay 1099-K Explained for 2025: Thresholds, Write-Offs, and What to Do.

Quick glossary (simple explanations)

1099-K: A paper that tells the IRS how much money moved through eBay for you. It does not mean you owe that amount in taxes.

Threshold: A line or limit. If you go over it, eBay must send the 1099-K form.

Gross payments: All the money buyers paid before anything is taken out. This is the big number on the 1099-K.

Profit: The money you actually keep after paying for the item, fees, shipping, and other costs.

Personal item: Something you bought for yourself and used, like clothes, furniture, or an old phone.

Business item: Something you bought mainly to sell again and make money.

Deduction (write-off): A cost you are allowed to subtract so you don’t pay tax on money you didn’t keep.

Inventory: Items you bought to sell but have not sold yet.

Calendar year: January 1 to December 31. Only what happens in those dates counts for that year.

Zero out: Showing that a sale did not make money, so you do not pay tax on it.

Section 179: A tax rule that may let a business deduct the full cost of equipment in one year instead of spreading it out.

Cost of goods sold (COGS): What you paid for items that actually sold. If you bought ten items and sold four, COGS is the cost of those four, not all ten.

Backup withholding: When eBay holds back some tax money because your tax information was missing or didn’t match. This can trigger a 1099-K even if sales were low.

Sole proprietor: A one-person business where you and the business are the same for tax purposes.

Single-member LLC: A one-owner company. For taxes, it’s often treated the same as a sole proprietor unless you choose otherwise.

Estimated taxes: Payments you may need to send during the year if you make steady profit, instead of waiting until tax time.

Reconciliation: Matching your records to the 1099-K so every dollar makes sense and nothing looks missing.

Final thought

Part-time sellers do not get into trouble because they sell on eBay. They get into trouble because they guess. Clear records turn the 1099-K from something scary into something boring. And boring is good.

If keeping track of fees, shipping labels, and records manually is what stresses you out, see how sellers organize everything in one place with MyListerHub. It’s designed to reduce guesswork so tax season stays boring.

Common Questions Sellers Ask:

Does a 1099-K from eBay mean I owe taxes on all that money?

No. A 1099-K shows gross payments, not profit. You only pay taxes on the money you keep after costs like fees, shipping, and what you paid for the item.

Do I have to report eBay income if I’m just a part-time seller?

Yes. If you make a profit selling on eBay, it must be reported, even if eBay is only a side hustle. The amount you owe depends on profit, not total sales.

If I sold personal items on eBay at a loss, do I owe taxes?

Usually no. If you sold personal items for less than you paid, there is no taxable profit. Even if you receive a 1099-K, your tax return can show that no income was made.

by David Green