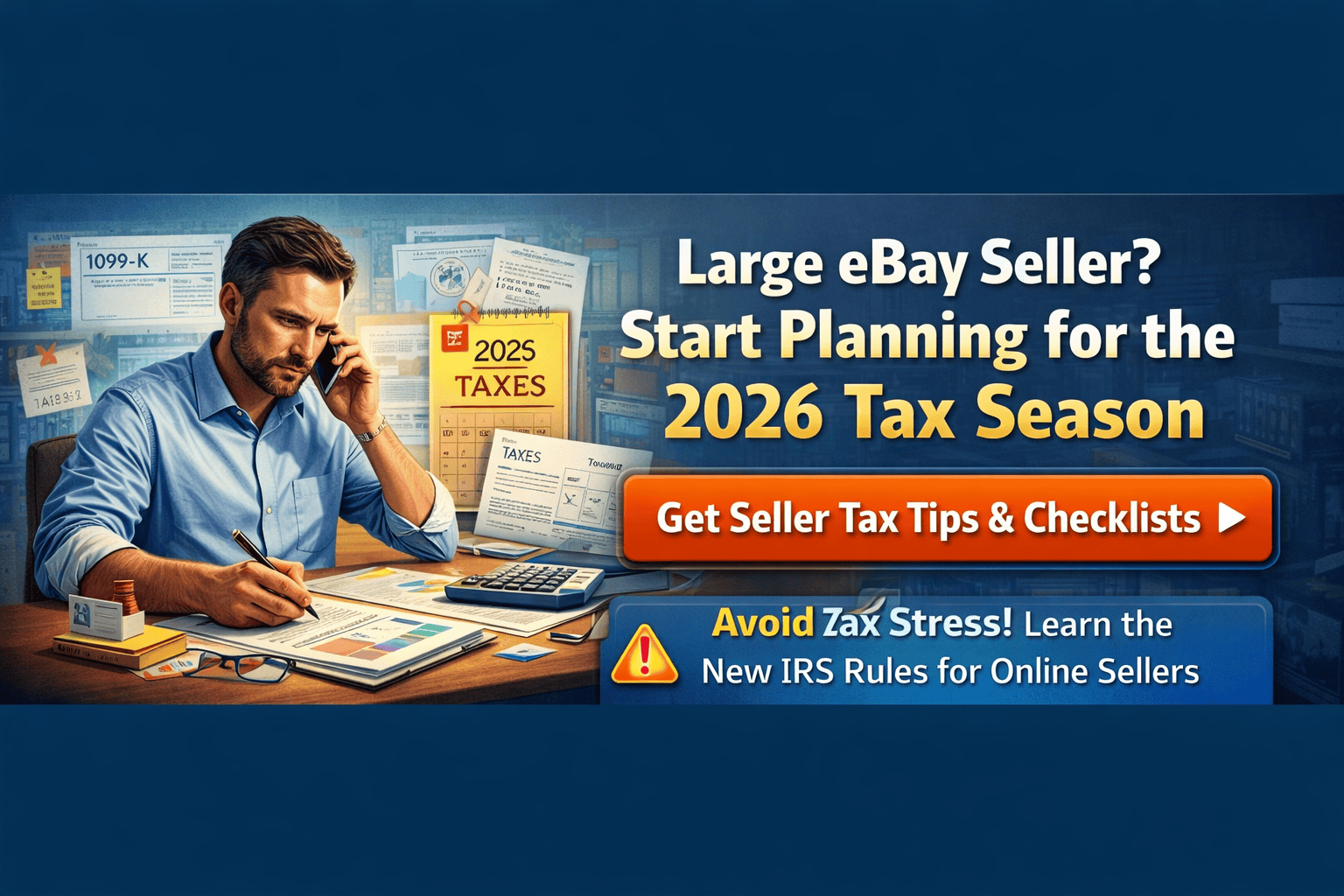

eBay Seller Taxes 2026: How Large eBay Sellers Should Plan for Tax Season Under the New Rules

2026 tax rules are stricter for eBay sellers. Learn how to structure inventory, deductions, and quarterly payments to stay compliant and protect cash flow.

January 14, 2026

Tax season in 2026 is very different for large eBay sellers than it was just a few years ago.

Between stricter IRS reporting, expanded 1099-K enforcement, marketplace facilitator rules, and tighter profit tracking expectations, high-volume eBay sellers can no longer afford to “figure it out later.” The sellers who stay profitable are the ones who plan for taxes all year, not just in April.

This guide breaks down how large eBay sellers should prepare for the 2026 tax season, what’s changed under the new rules, and how to build a clean, defensible tax strategy that protects cash flow and avoids surprises.

Why 2026 Is a Critical Tax Year for eBay Sellers

In 2026, tax enforcement around online marketplaces is no longer theoretical. It’s active.

The IRS now treats large eBay sellers much closer to traditional businesses than casual online sellers. That means:

- Higher reporting accuracy expectations

- Less tolerance for estimation

- More scrutiny on deductions

- Clearer paper trails between platforms, banks, and tax filings

If you sell at scale on eBay, your tax strategy must evolve accordingly.

Understanding the 1099-K Rules for 2026

What the 1099-K Means for eBay Sellers

In 2026, eBay continues issuing Form 1099-K to sellers who exceed IRS reporting thresholds. This form reports gross sales, not profit.

That distinction is critical.

The IRS sees:

- Total transaction volume

- Before fees

- Before refunds

- Before shipping costs

- Before cost of goods sold

If your books don’t reconcile cleanly with your 1099-K, that’s where problems start.

Why Gross Sales Reporting Creates Tax Risk

Many sellers panic when they see their 1099-K because the number is far higher than their actual profit.

This is normal - but only if you have:

- Proper expense tracking

- Accurate fee calculations

- Clear cost documentation

Without those, sellers risk overpaying taxes or triggering audits.

How Large eBay Sellers Should Structure Their Tax Planning in 2026

1. Separate Business and Personal Finances (Non-Negotiable)

If you’re still using personal bank accounts or cards for eBay sales in 2026, that’s a red flag.

Large sellers should have:

- A dedicated business checking account

- A separate business credit card

- Clean deposits from eBay payouts

This makes reconciliation, deductions, and audits far easier.

2. Track eBay Fees as a Core Expense Category

eBay fees are one of the largest deductible expenses for sellers, yet many underreport them.

This includes:

- Final value fees

- Payment processing fees

- Promoted listing fees

- International transaction fees

Every dollar in fees reduces taxable income but only if it’s tracked properly.

3. Treat Shipping Costs Correctly

Shipping is deductible, but only when categorized correctly.

This includes:

- Shipping labels

- Packaging materials

- Freight and international shipping

- Returned item shipping

Large sellers should separate shipping paid by buyer vs shipping paid by seller for cleaner reporting.

4. Cost of Goods Sold (COGS) Is Everything

Your cost of goods sold is the foundation of your tax liability.

COGS includes:

- Purchase price of inventory

- Import costs

- Manufacturing or sourcing costs

- Storage related to inventory

Without accurate COGS, profit calculations - and taxes are wrong.

New Tax Considerations for High-Volume eBay Sellers in 2026

Inventory Accounting Matters More Than Ever

Large sellers must be consistent with inventory accounting methods.

Most common methods:

- FIFO (First In, First Out)

- Specific identification (for high-value items)

Inconsistent inventory tracking can lead to:

- Overstated income

- Disallowed deductions

- IRS questions

State Sales Tax and Marketplace Facilitator Rules

eBay continues to collect and remit sales tax on behalf of sellers in most states. However:

- Marketplace-collected tax is not your income

- It should not be included in revenue

- It must still reconcile with reports

Large sellers should ensure sales tax does not inflate taxable income figures.

Estimated Quarterly Taxes Are No Longer Optional

High-volume sellers often owe significant taxes before April.

In 2026, many eBay sellers must:

- Pay quarterly estimated taxes

- Avoid underpayment penalties

- Forecast cash needs ahead of time

Waiting until tax season can create major cash flow stress.

Profit First vs Tax First: A Smarter 2026 Strategy

Many sellers focus on profit without accounting for taxes. That leads to problems.

A smarter approach:

- Calculate net profit per item

- Set aside tax reserves monthly

- Treat tax money as untouchable

This prevents the common mistake of spending money that belongs to the IRS.

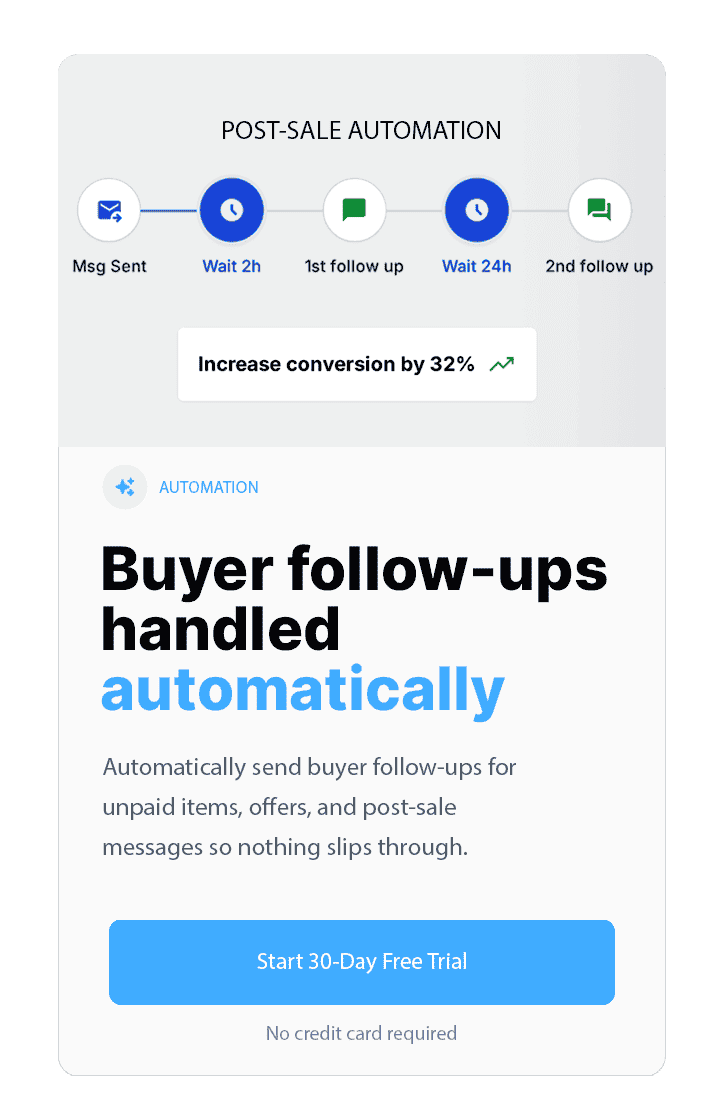

How Automation Helps Sellers Prepare for Tax Season

Manual spreadsheets don’t scale for large sellers anymore.

Modern sellers rely on tools that:

- Track real profit per sale

- Separate fees, shipping, and inventory

- Reconcile payouts with sales volume

- Support accountant-ready reporting

This reduces errors, saves time, and lowers audit risk.

How MyListerHub Supports Tax-Ready Selling

MyListerHub helps sellers understand their numbers before tax season arrives.

By tracking:

- True profit per listing

- eBay fees and promotion costs

- Price optimization for margin protection

Sellers can make decisions that reduce taxable income legitimately, without scrambling at filing time.

When tax season comes, sellers who already know their numbers are far better positioned.

Common Tax Mistakes Large eBay Sellers Make

Avoid these costly errors in 2026:

- Relying solely on the 1099-K number

- Guessing inventory costs

- Forgetting to deduct promoted listings

- Mixing personal and business expenses

- Waiting until March to organize records

Each of these increases financial and legal risk.

Common Question Sellers Ask:

Do eBay sellers need to report income even if they don’t receive a 1099-K?

Yes. All income is taxable, whether or not a form is issued.

Is the 1099-K the amount I pay taxes on?

No. Taxes are based on net profit, not gross sales.

Can eBay fees be deducted?

Yes. All eBay selling fees are deductible business expenses.

Should large sellers work with a CPA?

In most cases, yes. A CPA familiar with e-commerce can help optimize deductions and avoid errors.

How early should sellers prepare for tax season?

Ideally year-round. Waiting until tax season limits options and increases stress.

by Omri Ross