Selling on eBay vs Other Marketplaces in 2026: What Actually Works for Sellers

In depth 2026 guide comparing selling on eBay with other marketplaces such as Poshmark, Mercari, Depop, GOAT, StockX, Whatnot, The RealReal and more. Learn where sellers actually make money, when it makes sense to expand beyond eBay, and when it is smarter to pull back.

December 4, 2025

Selling on eBay and Other Marketplaces in 2026: Who Really Wins for Sellers

If you are selling online in 2026, you are not short on options. eBay is still the giant of resale, but it sits within a much bigger ecommerce landscape dominated by Amazon and Walmart. Amazon alone controls roughly 38% of United States ecommerce spending, while Walmart sits in second place with around 75% of the market, making the rest of the field look small at first glance.

You might be thinking: if Amazon and Walmart are that big, why aren't we comparing eBay to them in this article? The reason is simple. Once you zoom in on second-hand goods, used car parts, fashion resale, luxury items, sneakers, watches, and one-of-a-kind pieces, the landscape changes completely. In those categories, Amazon and Walmart are not the main competitors to eBay. The real alternatives are the resale and niche marketplaces we are about to talk about, such as Poshmark, Mercari, Depop, GOAT, Grailed, Vinted, Whatnot, StockX, The RealReal, Worthy, and 1stDibs.

Sellers hear the same advice over and over. You should be everywhere. You are leaving money on the table if you only sell on eBay. On paper, that sounds smart. In reality, many sellers find that most of their profit still comes from eBay, while the extra marketplaces create more stress than they generate sales.

This article takes a practical look at how eBay compares to the other marketplaces that overlap with it in the United States. You will see how each platform grew, what it is actually good at, where it falls short, and how realistic it is to add it to an existing eBay business. You will also see what real sellers told us at the most recent eBay Open in Las Vegas, when we spoke with close to 1,000 eBay sellers about cross-listing and multi-marketplace management.

Quick Snapshot: eBay vs Other Marketplaces in 2025

Before we go into details, here is a quick high-level comparison. The numbers are based on the most recent publicly available data and may change over time. The important part is the relative scale and focus of each platform, not the exact number down to the last user.

| Marketplace | Buyers | Sellers | Typical Fees | Main Focus |

|---|---|---|---|---|

| eBay | 134 Million | 18 Million | 7-15% | General marketplace with almost every category |

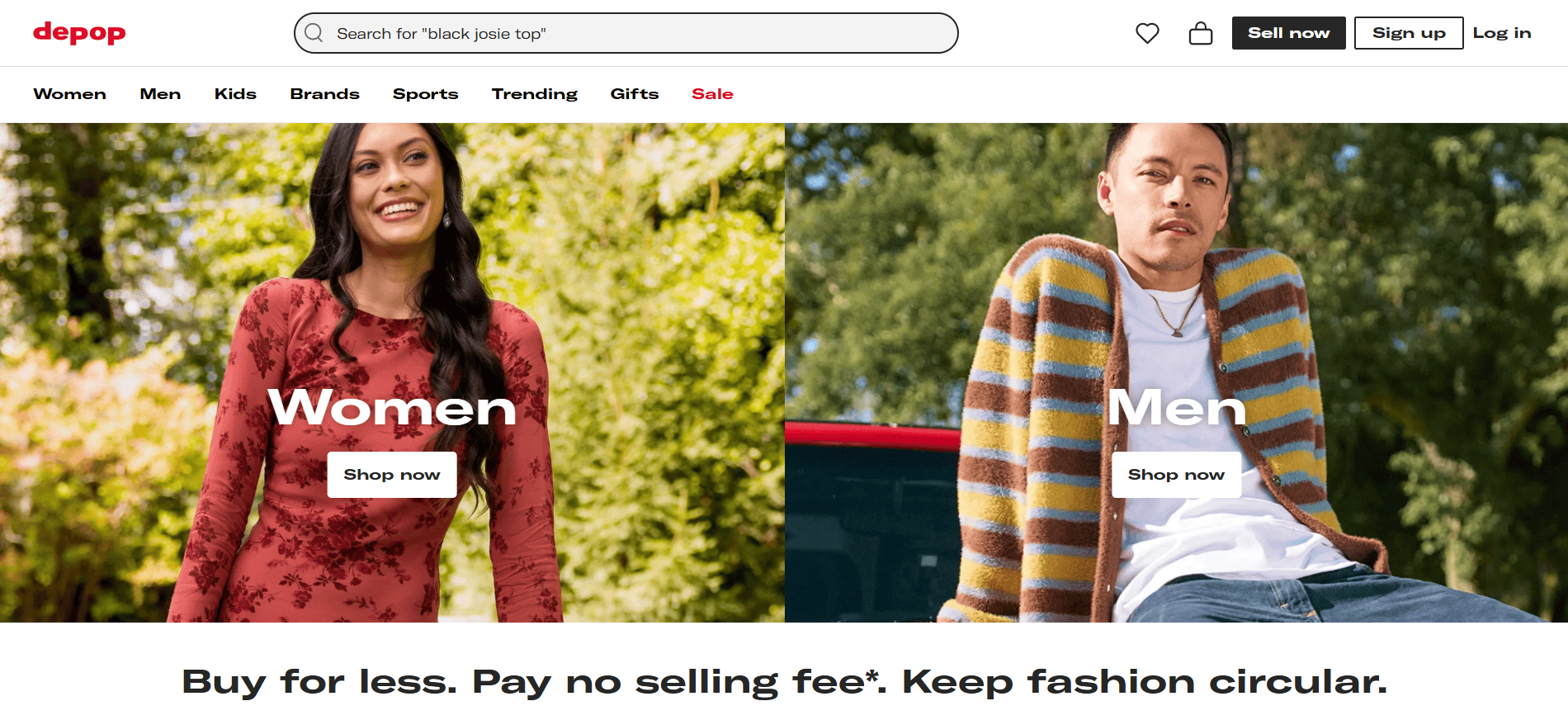

| Depop | 5 Million | 2.5 Million | 10% + Payment fees | Gen Z fashion and vintage clothing |

| GOAT | 50 Million | 1 Million | 9-15% | Sneakers and streetwear |

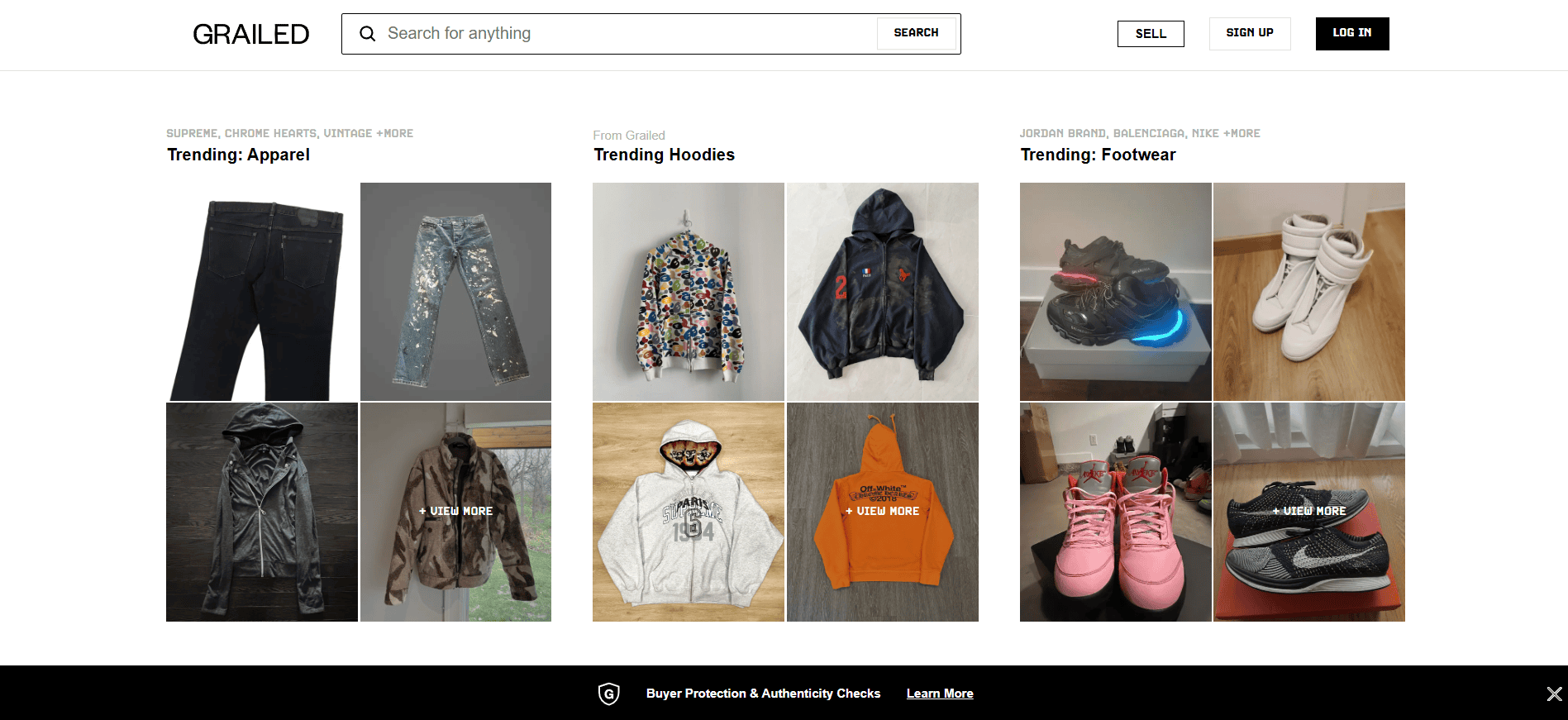

| Grailed | 10 Million | N/A | 9% | Men’s fashion and luxury streetwear |

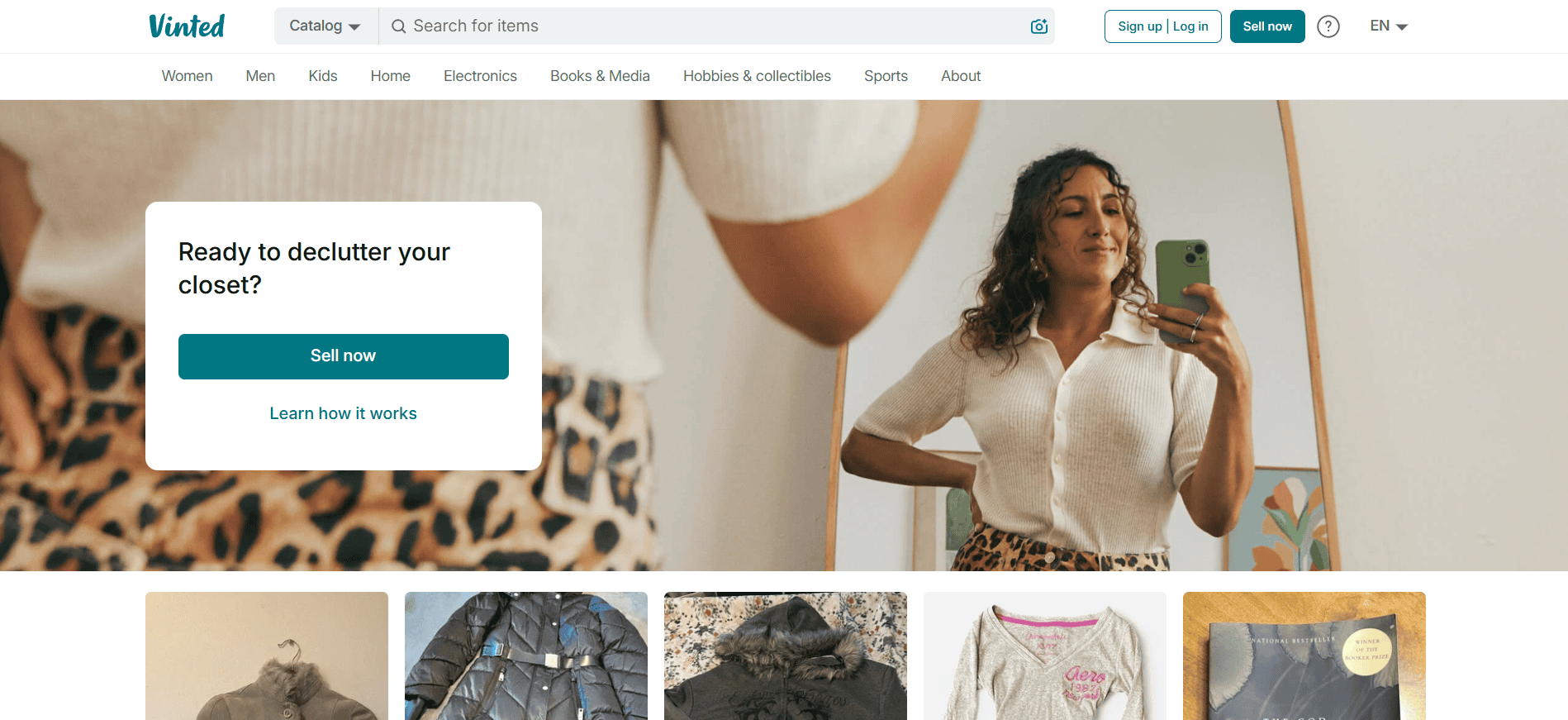

| Vinted | 100 Million | N/A | 0% | Clothing and secondhand fashion |

| The RealReal | 40 Million | N/A | 20-45% | Luxury, jewelry, watches, handbags |

| Mercari | 23 Million | N/A | 10% | General decluttering, clothing, electronics, toys |

| Poshmark | 8 Million | 5.1 Million | 20% above $15 | Fashion, home goods, beauty |

| Whatnot | 3 Million | 5,000 | 8-15% | Live selling for collectibles & pop culture items |

| StockX | 20 Million | 1.7 Million | 8-10% | Sneakers, watches, trading cards, collectibles |

| Worthy | 1,000 | N/A | 10-20% | Fine jewelry and luxury watches |

| 1stDibs | 2 Million | 12,000 | 15% + listing fees | High end jewelry, antiques, art, decor |

You can already see a pattern. Most of these platforms are strong in one category or one type of buyer, while eBay is the broad, multi-category foundation that covers almost everything from car parts to jewelry to trading cards.

Why eBay Is Still the Benchmark for Online Sellers?

To make sense of all these marketplaces, it helps to start with one simple idea. Treat eBay as the baseline. eBay is not perfect, but it has three things that almost no one else can match at once.

First, scale. The number of active buyers on eBay, especially in the United States, still beats most other platforms by a wide margin. When you list something on eBay, your potential audience is massive. Second, the category range. You can sell used clothing, new clothing, auto parts, jewelry, watches, sports cards, electronics, home decor, and thousands of other categories in a single account. Third, seller tools. eBay has a mature seller hub, bulk editing, shipping label options, promotions, and plenty of ways to automate or streamline parts of your workflow.

On the flip side, eBay can feel complex. Listing forms have many fields, policies, and categories that matter, and the interface is not as slick as the newer apps. It takes time to learn how to use it well. Some sellers feel that eBay is less fun or less social than platforms like Poshmark or Depop.

When you compare other marketplaces to eBay, the real question is not “Is this a good platform?” The real question is, “Does this platform bring enough extra profit to justify the extra work once I already have eBay running?” That is the lens we will use as we go through each marketplace.

If your conversion on your eBay store is down, and you are thinking about chasing a new marketplace, read how to Optimize Stale Listings on eBay: Proven Tips to Boost Visibility and Sales

Depop

Depop built its reputation as the social app for used fashion. The interface looks a lot like a social feed. Sellers post photos that feel like outfit shots. Buyers scroll and like items, save them to collections, and follow sellers whose style they like. The main audience is young and trend-driven. Vintage tees, Y2K fashion, small brand streetwear, and handmade pieces do well here.

For closet sellers and small hobby resellers, Depop can be a fun and profitable platform. It lets people turn personal style into a microbrand. The downside appears when you try to scale. The buyer pool is much smaller than eBay. Shipping flows are not as advanced. Counterfeit items and low communication standards can be an issue. Many sellers notice that pieces they cross-list between Depop and eBay tend to sell on eBay first, simply because of volume.

If your entire business is built on Gen Z style fashion and you enjoy the social aesthetic, Depop can be a helpful side channel. If your goal is to run a serious reselling operation, it usually ends up as a secondary platform behind eBay rather than a replacement.

GOAT

GOAT entered the market with a clear mission: to provide safe sneaker resale through authentication. Every pair undergoes verification, which solves a major problem in the sneaker world. Serious collectors and hype buyers trust GOAT because they feel more confident about what they are getting. Over time, GOAT expanded into apparel and accessories, but sneakers are still the core.

For sellers who focus heavily on high-end sneakers, GOAT is attractive. It brings in targeted buyers who are willing to pay for rare pairs. Fees are not cheap, though, and categories are limited. You cannot use GOAT to move random clothes, car parts, or electronics. If you want one hub for most of your inventory, GOAT will never be that hub.

eBay reacted with its own authentication programs for sneakers and other categories. This allowed sellers to offer similar peace of mind with more control and broader category reach. Many sneaker resellers now list on both GOAT and eBay, but when they look at total revenue, they often find that eBay still generates the majority of their sales once all categories are included.

Grailed

Grailed has a very specific vibe. It is the platform where you go if you are a menswear nerd or a streetwear collector. Items such as archive designer pieces, limited-edition streetwear collaborations, and niche fashion labels attract a more concentrated audience on Grailed than on broader platforms. Buyers tend to know what they are looking at and what it is worth, which can help the right listings sell quickly.

However, Grailed has had recurring issues with fraud complaints and confusion around protections. The overall user base is much smaller than eBay, and the marketplace is focused on a narrow segment of clothing. Sellers who handle only high-end menswear might like Grailed as their main channel, but many still list on eBay to reach more casual buyers and international customers.

If your brand is built around men’s fashion and you love that world, Grailed can be a strong niche tool. If your inventory is mixed, or you care most about reliable volume and infrastructure, eBay remains the sturdier base.

Vinted

Vinted grew very fast in Europe and continues to expand in the United States. The main appeal is simple. Vinted does not charge seller fees. Instead, buyers pay shipping and a small fee to Vinted. This structure makes it very attractive for casual sellers who want to clean out their wardrobes without seeing a cut taken from every sale.

For low-priced clothing, Vinted can make sense. It feels easy and risk-free to list items when you know you will keep the full sale amount. In the United States, though, the buyer base is smaller than in Europe and smaller than eBay’s. Many sellers see slower movement on Vinted compared to eBay, especially for higher-value items that require the right buyer.

From a workflow angle, Vinted is another inbox, another shipping system, and another set of notifications, for some sellers, that is absolutely worth it. For others, especially those who depend on predictable income from their online stores, the extra management load does not justify the additional sales.

The RealReal

The RealReal operates as a luxury consignment marketplace. Sellers send their items in, specialists authenticate and price them, and The RealReal handles the listing, photography, and sale. This is ideal for people who have a handful of high-value items, such as a luxury watch, a diamond bracelet, or a designer handbag, and do not want to learn how to sell online.

For regular resellers, the math is tougher. Consignment fees can range from around 20% to 40% depending on the category and the value of the item. That is a big chunk of margin to give up repeatedly. Since The RealReal controls pricing and presentation, sellers also lose flexibility in how they position their inventory.

eBay Authenticity Guarantee for watches, jewelry, sneakers, and handbags offers another way to give buyers confidence without giving up as much control or commission. Many sellers experiment with The RealReal for a few pieces, then shift to eBay once they see the difference in net profit.

Mercari

Mercari is the platform that made selling feel like decluttering. The mobile app is simple, the listing is quick, and the flat 10% fee is easy to understand. For many people, Mercari was the first time they ever sold anything online. It is especially popular for household items, clothing, electronics, and toys that people no longer need.

As a side hustle platform, Mercari works well. When you try to build a serious business on it, the cracks become more obvious. Analytics are basic, bulk management support is limited, and promotional tools are not as advanced as eBay’s. High-volume sellers often struggle to manage thousands of listings on Mercari because it was not designed as a professional seller hub like eBay.

Many full-time resellers in the United States use Mercari as a spillover channel. They push certain items there, especially if they're already photographed and described for eBay, but they still consider eBay their core marketplace. It is common to hear sellers say that Mercari is nice to have, but that their business cannot survive without eBay.

Poshmark

Poshmark stood out because it made reselling social. Closets have followers, there are virtual “Posh Parties”, and buyers can bundle multiple pieces from a single seller. Many shoppers like the personal touch, such as handwritten notes and creative packaging, which some sellers provide. This social energy made Poshmark very appealing, especially for women’s clothing and accessories.

The major downside is the fee structure. Poshmark charges a flat $2.95 for sales under $15, and 20% for anything over that amount. That is a big cut, especially as prices go up. For sellers who focus on mid and high-priced items, this fee can erase a large part of their margin. Sales velocity has also cooled as more competition appears in the fashion resale space.

Poshmark still works for hobby sellers and boutique-style resellers who want community and are willing to pay for it. For full-time sellers who rely on net profit and scalability, eBay often looks more attractive, especially if they sell in categories beyond clothing.

Whatnot

Whatnot is built around live selling. Sellers host real-time shows where they showcase items, talk to viewers, and run rapid auctions. This format is perfect for trading cards, comics, toys, and other collectibles, where excitement and impulse bidding can drive final prices higher. Sellers who are comfortable on camera and enjoy performing can do very well here.

The challenge is that live selling is demanding. You cannot automate a live show. You have to show up, be present, and keep your energy up. That is hard to scale on your own. Logistics after the show can also feel intense because there are many small orders that need to be pulled, packed, and shipped.

eBay has its own live selling features, but Whatnot still leads in this space. Many sellers use Whatnot for occasional events and keep their long tail inventory on eBay, where it can sell quietly over time. That combination of “event sales” on Whatnot and “evergreen listings” on eBay seems to be the most common pattern.

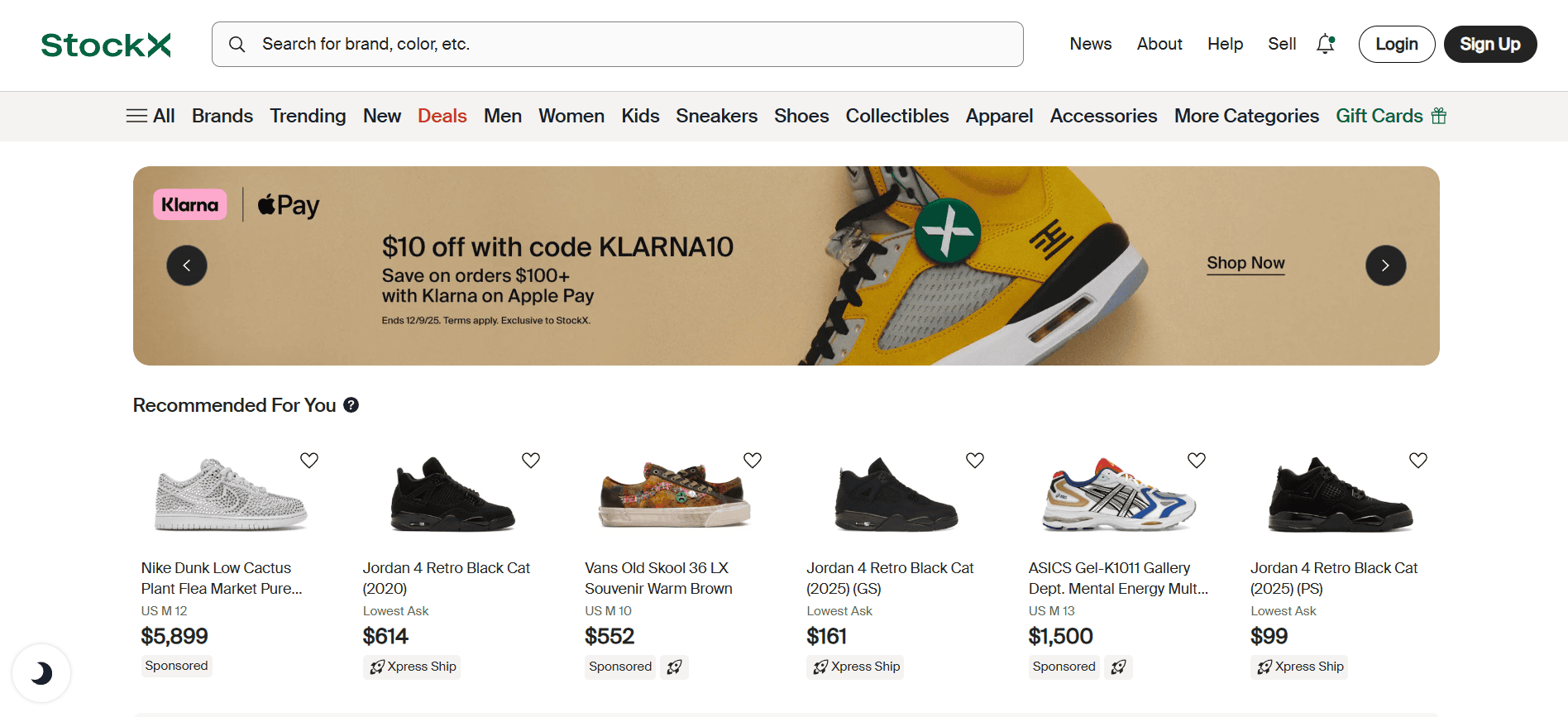

StockX

StockX took a stock exchange idea and applied it to sneakers and collectibles. Buyers place bids, sellers place asks, and sales execute when there is a match. Every item goes through an authentication center, so buyers know they are getting authentic products. For serious sneaker and collector communities, this model made a lot of sense.

Even with these strengths, StockX has limitations. It focuses on sneakers, watches, and a few specific collectible categories. Customer service and shipping complaints have been common over the years. Fees are not negligible either. If you sell broadly across many categories, StockX will never be your main channel.

eBay’s own authentication and its wider category support make it more flexible. Many sellers experiment with StockX, especially for certain shoes or watches, but when they look at their yearly numbers, they still see eBay carrying most of the workload.

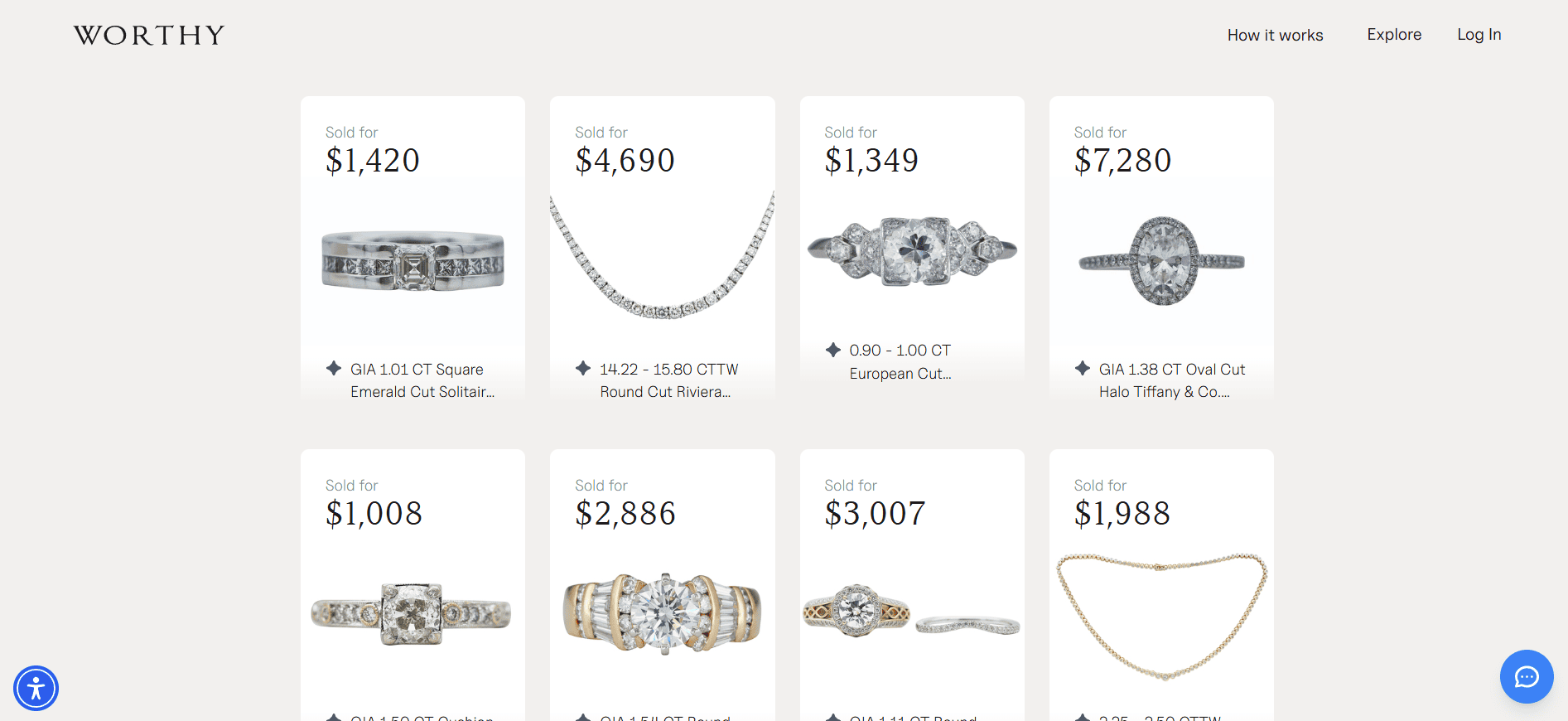

Worthy

Worthy is a niche marketplace that specializes in fine jewelry and luxury watches. Instead of listing items directly to public buyers, you send your piece to Worthy. They evaluate it, create a listing, and auction it to a network of more than one thousand vetted professional buyers. This appeals to people who want a guided process rather than doing everything themselves.

The tradeoff is that it behaves more like consignment. It takes time and fees, which are generally lower than some luxury consignment platforms, but still cut into the final payout. The audience is narrower than eBay’s, and pricing depends heavily on who shows up for that particular auction.

Professional jewelry sellers often find that eBay, combined with strong photos and detailed descriptions, gives them more control and access to a larger pool of buyers. Worthy remains an interesting option for specific high-value pieces, especially for one-time sellers, but less so as a primary channel for serious jewelry businesses.

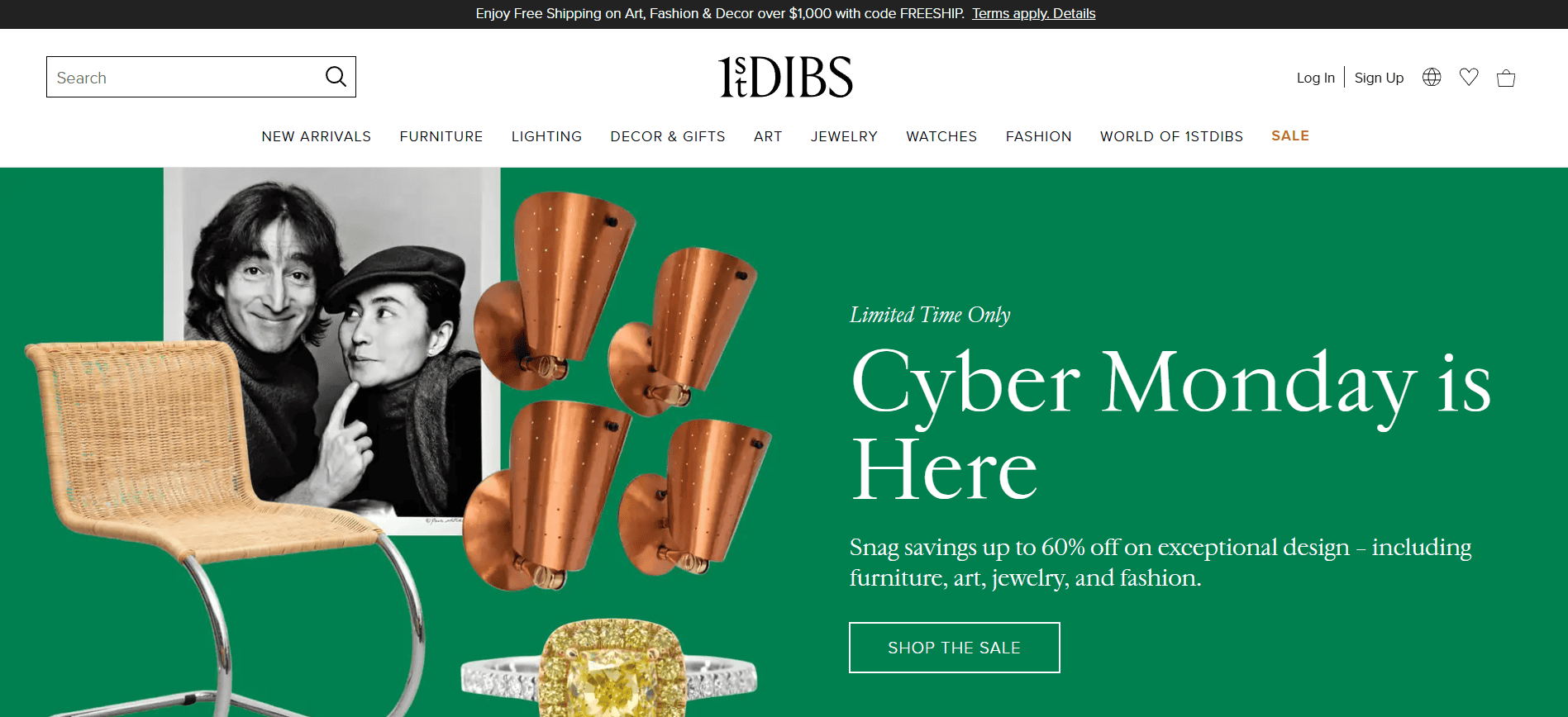

1stDibs

1stDibs sits at the high end of the market. It is a curated marketplace for luxury jewelry, antiques, art, and high-end decor. Sellers must go through a vetting process and are expected to maintain a certain standard of presentation and authenticity. Buyers on 1stDibs are often designers, collectors, or affluent homeowners looking for special pieces.

For sellers who qualify, 1stDibs can be very powerful. The audience is highly targeted and willing to spend. However, fees are higher than on eBay, the standards are stricter, and the application process filters out many potential sellers. It is not an open-door platform.

Most dealers who use 1stDibs still use eBay. They treat 1stDibs as a premium gallery for top-tier items and eBay as the workhorse that moves a broader mix of inventory and fills in the gaps between big luxury sales.

Why Most Sellers Still Rely on eBay as Their Main Sales Channel?

At the most recent eBay Open in Las Vegas, MyListerHub exhibited and spoke with nearly 1,000 eBay sellers. These were sellers from different categories and different sizes, from part-time resellers to full-time operations. The patterns in what they said were hard to ignore.

Most sellers told us that the majority of their online revenue still comes from eBay. For many of them, eBay was not just a bit ahead; it was the core of the business. Some sellers estimated that 80-90% of their online sales came from eBay, while the remaining 10-20% came from a mix of marketplaces like Poshmark, Mercari, Depop, and other niche platforms.

They also talked about the stress of managing multiple platforms. It was not the listing itself that burned them out; it was everything that came after. Keeping inventory synced, responding to messages in multiple apps, remembering different return rules, and juggling multiple payout schedules. Several sellers described feeling like they were drowning in admin work before they even started packing orders.

A major point of frustration was overselling. Many sellers had stories of an item selling on one marketplace, only for the same item to be bought on another platform a few hours later because the quantity did not update in time. That led to cancellations, open cases, negative feedback, and sometimes account flags. Instead of feeling empowered by more marketplaces, they felt trapped by them.

It is important to be clear that MyListerHub is not affiliated with eBay. These are real experiences from sellers who shared their thoughts frankly at the event.

Look for event recap articles that summarise the most common pain points sellers shared at eBay Open at eBay Open 2025 Recap: What Happened, What’s New, and How MyListerHub Powers Ahead

When to Expand to More Marketplaces and When to Pull Back?

With so many marketplaces available, the main question is not “Which platform is the best?” The main question is “Which platforms actually help my business right now?” Knowing when to expand and when to pull back can save you a lot of time and stress.

It makes sense to expand when your eBay operation is already solid. That means your listings are accurate, you ship on time, your defect rate is under control, and you have the capacity to take on additional tasks. If you sell in a niche that aligns perfectly with another marketplace, testing a second platform can be smart. Sneakers might justify a test on GOAT or StockX. High-end jewelry might make The RealReal or Worthy worth a trial. Luxury decor might earn a place on 1stDibs. Start with a small segment of your inventory, measure results for a few months, and be honest about whether the extra income is worth the extra work.

On the other hand, there are signals that it is time to pull back. If you look at your numbers and see that almost all of your income comes from eBay, while other marketplaces contribute very little, it may not make sense to keep feeding them. If constant overselling or channel-sync issues are causing stress and damaging your reputation with buyers, that is another red flag. If you find yourself constantly updating listings, fixing issues, and answering messages for platforms that bring in a tiny percentage of your total profit, you are likely overextended.

You do not owe any marketplace permanent loyalty. It is perfectly acceptable to pause or close a channel that is not performing for you. In many cases, sellers feel real relief when they simplify and put more energy back into their main eBay store. Being focused can grow your business more than chasing every new option.

Why eBay Still Needs to be Your Main Marketplace in 2026?

Other marketplaces have brought important innovations into the resale world. Poshmark proved that community-driven fashion can work. Whatnot showed that live selling can be fun and profitable. StockX and GOAT raised standards for sneaker authentication. The RealReal and 1stDibs shaped expectations around luxury curation. These innovations matter, and they have a role.

At the same time, eBay remains the only marketplace that combines a massive buyer base, category diversity, robust seller tools, and space for both casual and high-volume sellers in one place. It may not always be the coolest or the newest platform, but it remains the backbone of online reselling for a huge number of people in the United States.

The smartest move for most sellers in 2026 is to treat eBay as the foundation. Use it to build a stable, scalable business. Once that is in place, test other marketplaces intentionally and with clear expectations. Keep the ones that truly add profit and let go of the ones that only add work. Trends change every year, but consistent buyers and manageable workflows are what keep the lights on.

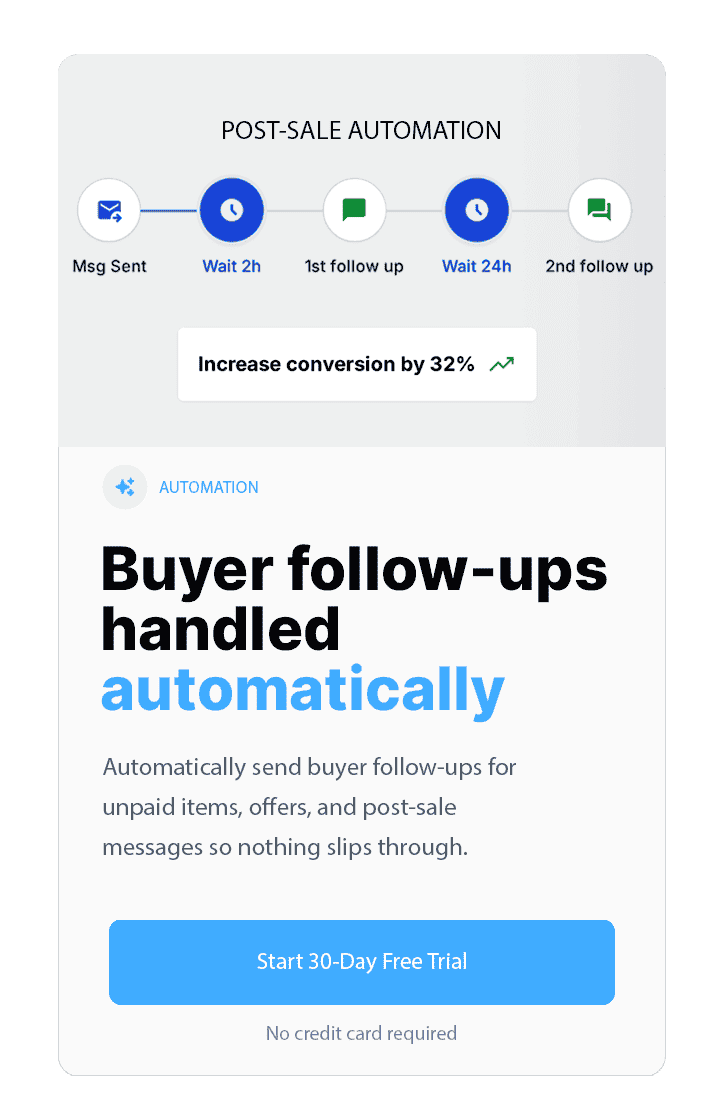

To learn about advanced ways to get more out of your eBay account, read How to Use eBay Automation to Refresh Old Listings and Increase Sales

Common Questions Sellers Ask:

Should I list products on multiple marketplaces?

Listing products on multiple marketplaces can help you reach new buyers, but it only makes sense after your main channel, usually eBay, is stable, profitable, and well-organized. If you already have strong systems for inventory management, shipping, and customer service, adding Poshmark, Mercari, Depop, or other platforms can drive additional sales in specific niches such as fashion, collectibles, or luxury items. However, if you are still struggling with out-of-stock issues, late shipments, weak profit margins, or messy processes on eBay, spreading yourself across several marketplaces usually makes everything harder, not better. A good rule is to master one marketplace first, then test additional platforms slowly.

What are the disadvantages of cross-listing?

As long as you have good software in place, cross-listing can be a huge advantage because it lets you push your inventory to multiple marketplaces without losing control. The problems usually start when sellers manage multiple marketplaces manually or when the software they use is not ideal for cross-listing or managing multi-channel inventory. Overselling can lead to canceled orders, negative feedback, open cases, unnecessary customer aggravation, and even account flagging.

Another hidden problem is that many cross-listing tools simply copy the eBay title and item specifics without optimizing them for each marketplace. For example, if you copy an 80-character eBay title directly to Poshmark, which allows 120 characters, your Poshmark listing will compete against other sellers who use the full title length and more SEO keywords, so they have a better chance to appear in search and get the sale.

Different marketplaces also treat item specifics and conditions differently. A condition such as “Open Box” on eBay might not exist on Mercari and could be mapped incorrectly as “New” or show up as an error. That confuses buyers and can cause returns or complaints. Over time, all of this extra work and mismatch between platforms can reduce your focus on eBay, hurt your main store performance, and lower your profit per hour, even if cross-listing slightly increases total revenue.